is irm stock dividend safe

If you have a stock whose dividend youd like me to analyze leave the ticker in the comments section. Marc and his team of experts provide retirement secrets and income.

Ex Dividend Reminder Telephone Data Systems Maxar Technologies And Iron Mountain Nasdaq

Investing less than 14000 into the stock would be enough to collect a dividend of 1000 over the course of a year if the current rate holds up.

. All of which leaves IRM stocks dividend on solid ground. The ex-dividend date is Wednesday. Dividend Safety Rating.

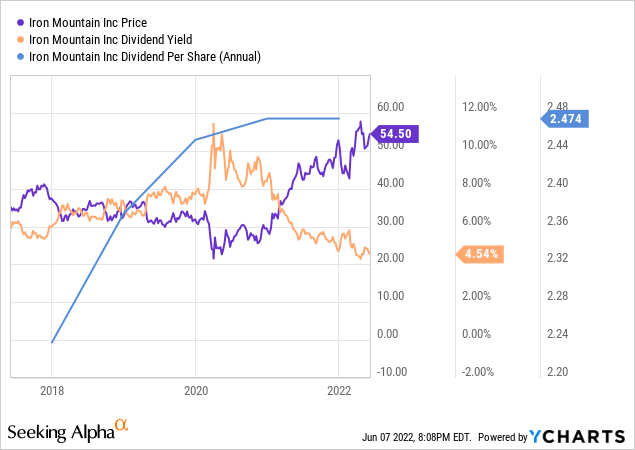

And thanks to record. Real estate investment trust REIT Iron Mountain IRM 146 has an 8-plus dividend yield which is pretty eye-catching at a time when the broader markets yield is below 2. It paid a flat dividend rate of 0618 for the past nine quarters a change from its past decade of steady annual yield rate increases.

The company began paying dividends in 2010 and made several special stock. That can make it hard to analyze the company but there are some financial truths that. Iron Mountains Dividend Safety Score of 65 indicating that the REITs dividend is safe and dependable.

For the latest dividend trends and insights sign up for the Wealthy Retirement e-letter below. The stock that will be used as an exampleand a. 20 rows IRM Dividend Safety Grade.

This high-dividend stock has seen the dividend increase 776. With a high-dividend stock the number one concern is the dividend payment being cut or eliminated. In fact this score is one of the better ones across the REIT sector.

To gauge the sustainability of a companys dividend one metric that investors should take a look at is the companys free cash flow per share on a trailing-12-month basis. ATT has used the proceeds from the Warner Bros. Chevron is a Dividend Aristocrat with a juicy dividend yield and great near-term growth prospects.

1 Ultra-Safe Dividend Growth Stock I Just Bought. IRM is a unique real estate investment trust REIT that basically has no direct peers. This represents a 247 annualized dividend and a dividend yield of 499.

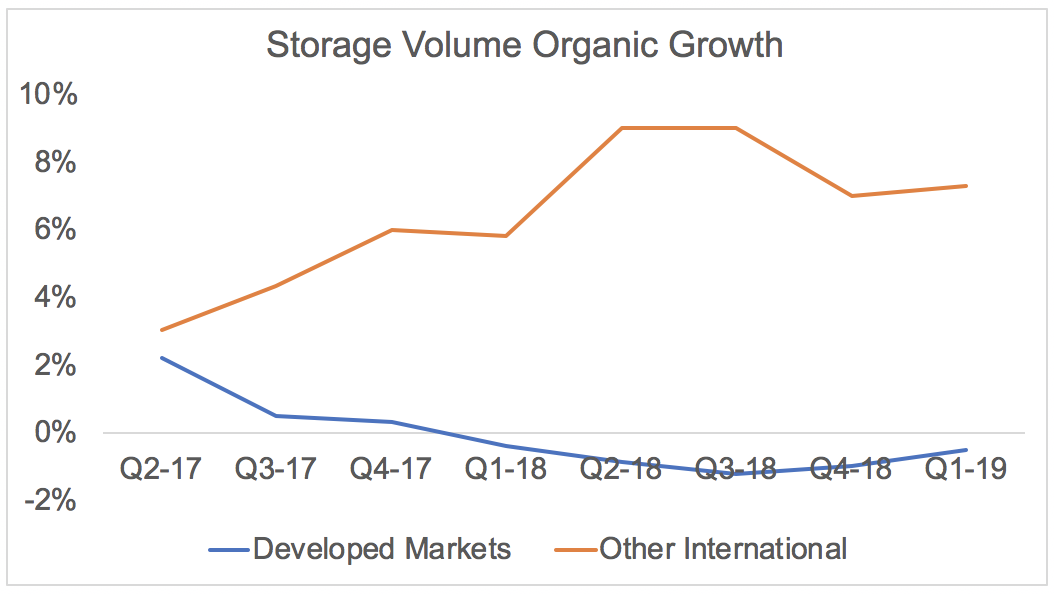

Pfizer has an attractive and fast-growing dividend along with solid long-term growth. In addition to The Coca-Cola Company NYSEKO Johnson Johnson NYSEJNJ and Exxon Mobil Corporation NYSEXOM The Sherwin-Williams Company NYSESHW is also one of the prominent dividend. Iron Mountain Simply Safe Dividends Although acquisitions still provide somewhat of a growth runway in developed markets there is a limit to how much expansion can ultimately be achieved from this profitable core business especially as more companies move to paperless ie.

As you can see the Iron Mountain dividend safety is at a high risk of being cut. IRM Stock is a Top High-Dividend-Paying Stock. Spinoff to reduce its debt.

Therefore you may want to keep a close eye on this dividend throughout the remainder of the year. But how safe is the. Iron Mountain NYSE.

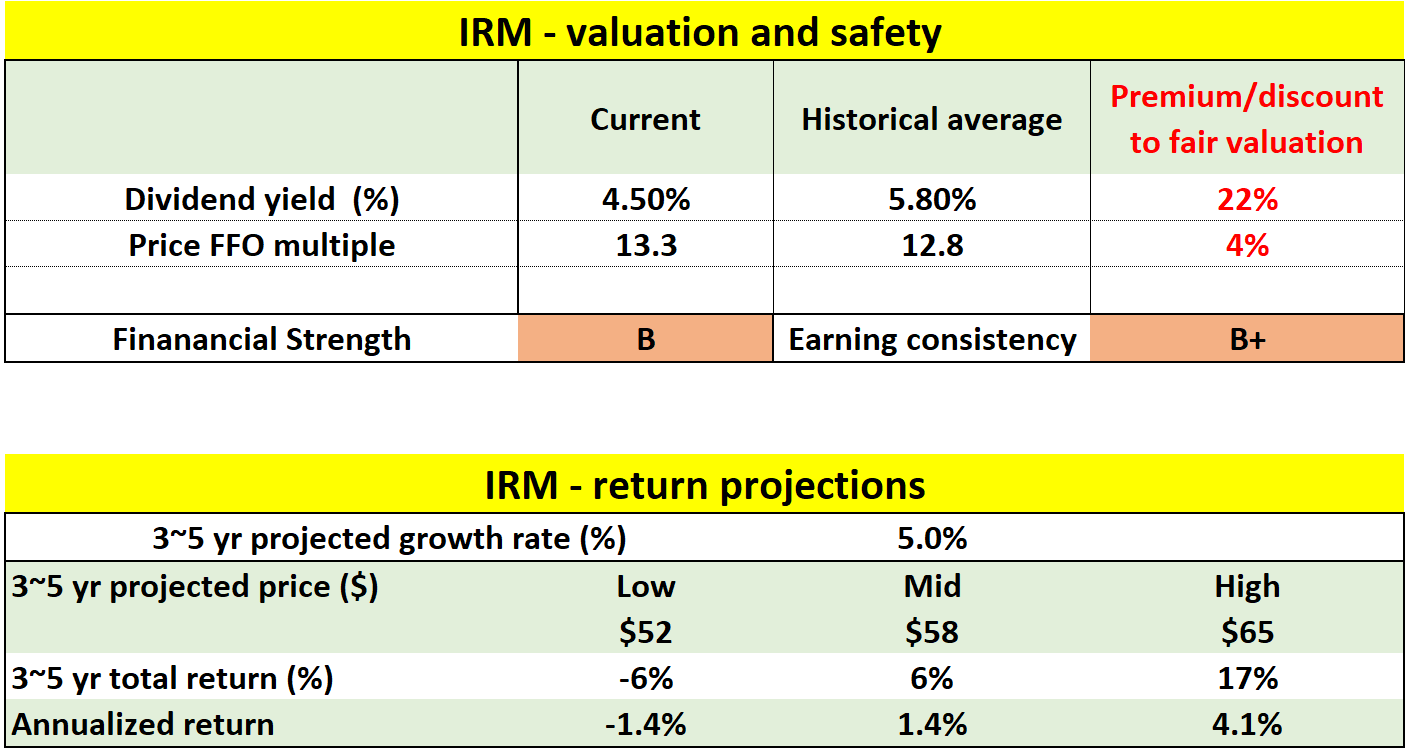

Iron Mountain Inc NYSEIRM is a bullish high-yield dividend stock that never seems to catch a break from analysts. While the companys dividend seems safe as the company pays 80 of. More often than not youll hear that IRM stock is overvalued and that the company cant afford to maintain its frothy dividends.

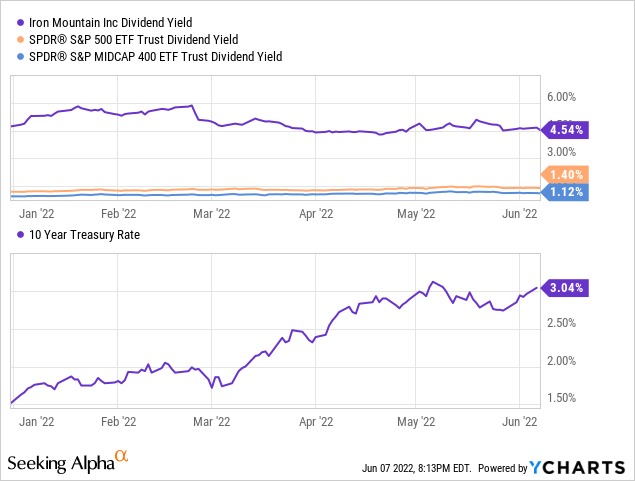

Iron Mountain IRM had been an attractive dividend stock but as IRM share price doubled from the pandemic crash the yield has become less appetizing. In a nutshell Iron Mountain not only pays a high dividend but the dividend is pretty safe. Market advice from the experts.

Youre reading a free article with opinions that may differ from The Motley. But Iron Mountain has managed to grow its share price and its dividends over the years. A safe dividend.

There are a few methods to determine if a dividend payment is safe. Stockholders of record on Thursday September 15th will be paid a dividend of 0618 per share by the financial services provider on Tuesday October 4th. This is a valid concern because a dividend payment is not mandatory by any means.

When reviewing Iron Mountains dividend profile keep in mind that the company didnt become a REIT until 2014. Lower interest payments combined with a smaller dividend give the company room to make growth investments. Iron Mountain Incorporated NYSEIRM declared a quarterly dividend on Thursday August 4th.

By Matthew Frankel CFP and Jason Hall - Aug 5 2022 at 830AM. The dividend yield is impressive at 66 but investors should take into account a halt in dividend increases in the short term.

What If I Invested 1000 In Iron Mountain Incorporated Irm 10 Years Ago

Iron Mountain An Interesting High Yield Stock Facing Several Risks Intelligent Income By Simply Safe Dividends

Iron Mountain Buy The Dividend Certainty Nyse Irm Seeking Alpha

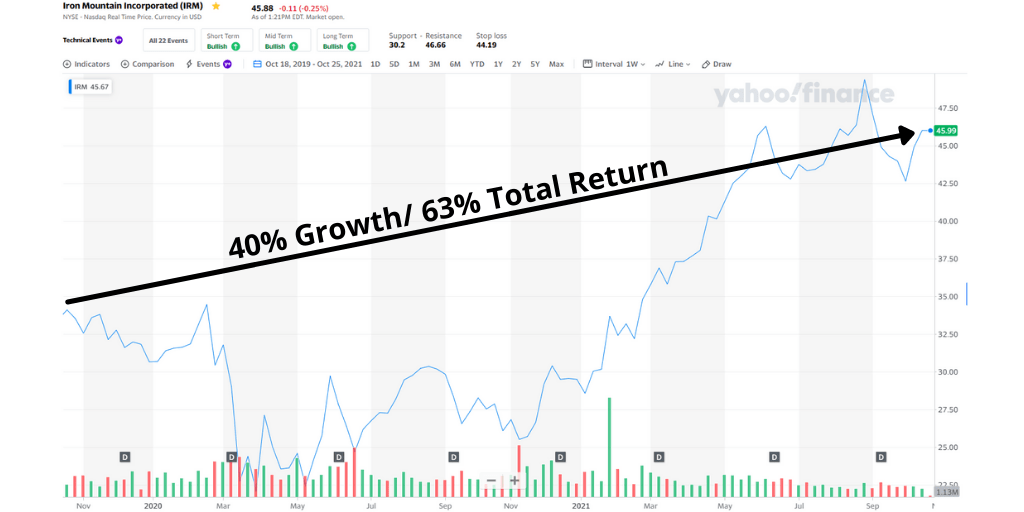

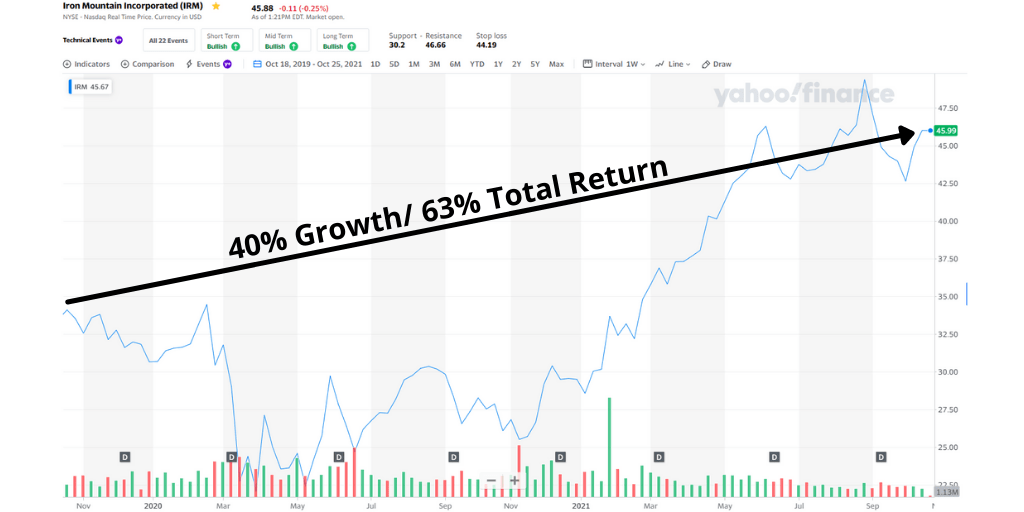

Iron Mountain Inc 8 4 Yielding Stock Could Run Higher In 2021

Iron Mountain Stock Offers An Iron Dividend Nyse Irm Seeking Alpha

Iron Mountain Stock Offers An Iron Dividend Nyse Irm Seeking Alpha

Iron Mountain A Strong Performing Reit Nyse Irm Seeking Alpha

Iron Mountain An Interesting High Yield Stock Facing Several Risks Intelligent Income By Simply Safe Dividends

Iron Mountain Stock Recent Dip Creates Entry Opportunity Nyse Irm Seeking Alpha

Iron Mountain An Interesting High Yield Stock Facing Several Risks Intelligent Income By Simply Safe Dividends

Irm Iron Mountain Inc New Dividend History Dividend Channel

What If I Invested 1000 In Iron Mountain Incorporated Irm 10 Years Ago

Iron Mountain Stock Downgrade To Hold After 33 Gain Nyse Irm Seeking Alpha

What If I Invested 1000 In Iron Mountain Incorporated Irm 10 Years Ago

Iron Mountain Dividend Safety Will This 9 25 Yield Fall Off A Cliff

How Safe Are Iron Mountain And Its Dividend The Motley Fool

Pin On Dividend Income Glory Investing Show

Iron Mountain An Interesting High Yield Stock Facing Several Risks Intelligent Income By Simply Safe Dividends